Whether it is an unexpected wake-up call like the collapse of Lehman Brothers, or simply the popping of a bubble that’s blown too big, the tides can shift in a matter of hours or days. No one knows this better than the world’s most elite investors – and that’s why billionaires like Warren Buffett, Ray Dalio, Bill Gross, Paul Tudor Jones II, and Carl Icahn take the necessary precautions available to protect themselves from these big and unexpected market swings.

5 Risks That Keep Billionaires Up at Night

Today’s infographic comes to us from Sprott Physical Bullion Trusts and it highlights some of the potential market risks that could move markets, as well as how these elite investors are hedging to protect their fortunes.

While these are all market risks that billionaires are concerned about, it’s worth mentioning that these kinds of events are almost impossible to predict or forecast. Despite the unlikelihood of them occurring, they all have the potential to impact markets – and that’s why elite investors are always active in hedging their investments.

A Note on Net Worth

Why are billionaires so concerned – after all, don’t they have lots of cash to protect themselves? It’s worth noting that on a relative basis, billionaires often aren’t very liquid at all. In fact, the majority of their net worth is usually tied up in business interests or other investments, and the value of these assets fluctuate with the market. That means a big market movement could wipe out millions or billions of dollars in the span of hours. For an extreme example of this, just look at Mark Zuckerberg, who saw his net worth plunge $6 billion in just one day in the wake of his company’s most recent privacy crisis.

The 5 Big Market Risks

Here are the risks keeping the world’s most elite investors up at night:

- The Return of Inflation Have central banks mastered monetary policy- or is there a chance that inflation could come back with a vengeance? After trending down for decades, billionaire Carl Icahn says that creeping inflation could lead to higher interest rates, which he thinks would be “difficult to deal with for the market”.

- Record High Debt The most recent number for global debt is at $233 trillion, and about $63 trillion of that is central government debt. Bill Gross, the “Bond King”, says that our system is dependent on leverage, and the critical values that affect this are debt levels, availability, and the cost of leverage. He said in a recent interview that “When one or more of these factors deteriorates, the probability of the model’s success and stability go down”.

- Bond Market Worries Last year, 84% of investors said that the corporate bond market was overvalued – and 82% said that the government bond market was overvalued. In a recent interview, hedge fund billionaire Paul Tudor Jones II predicted a price plunge, saying that “Bonds are the most expensive they’ve ever been by virtually any metric. They’re overvalued and over-owned.”

- Geopolitical Black Swans Elite investors continue to worry about geopolitical surprises that could impact markets, such as a trade war with China. We looked at this broad topic in depth in our previous infographic on geopolitical black swans.

- Overzealous Central Banks Lastly, many world-class investors are also concerned about the unintended aftereffects of massive central bank programs in recent years. With $13 trillion in total QE pumped into global markets since 2008, investors are worried about how much room that central banks have left to maneuver in a situation where the central bank “tool kit” is needed.

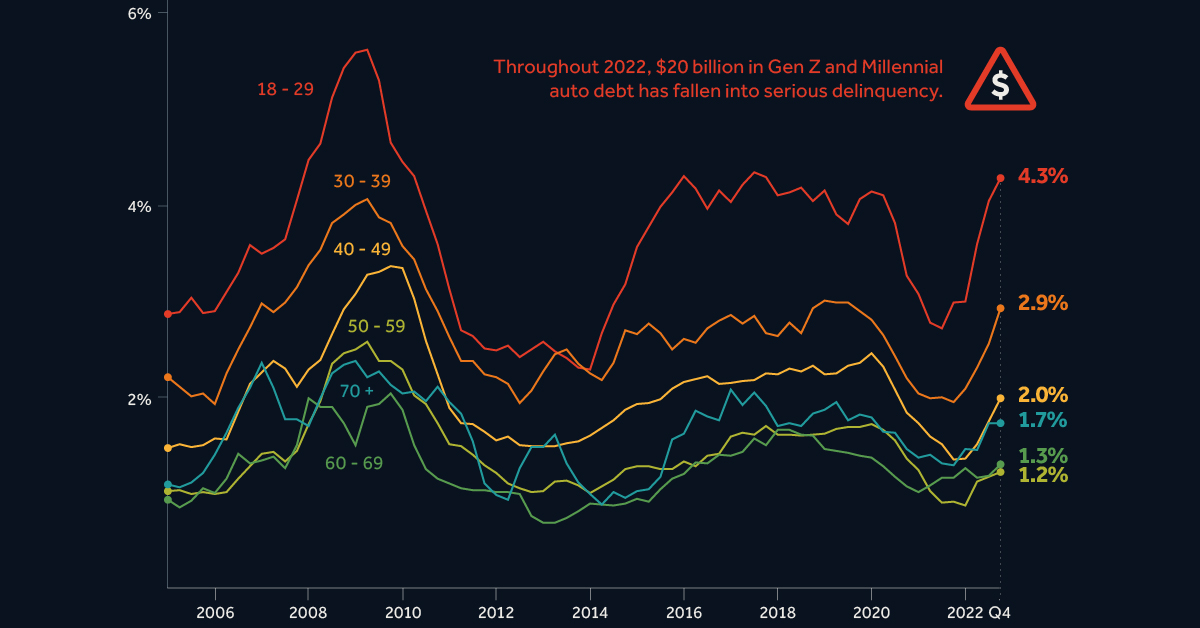

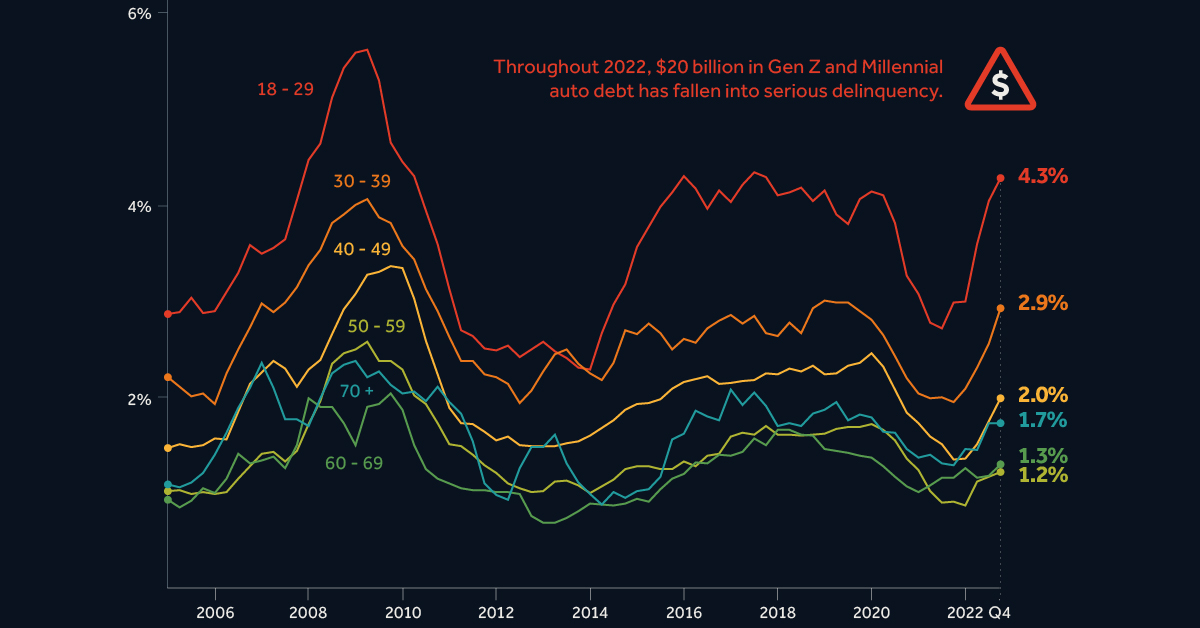

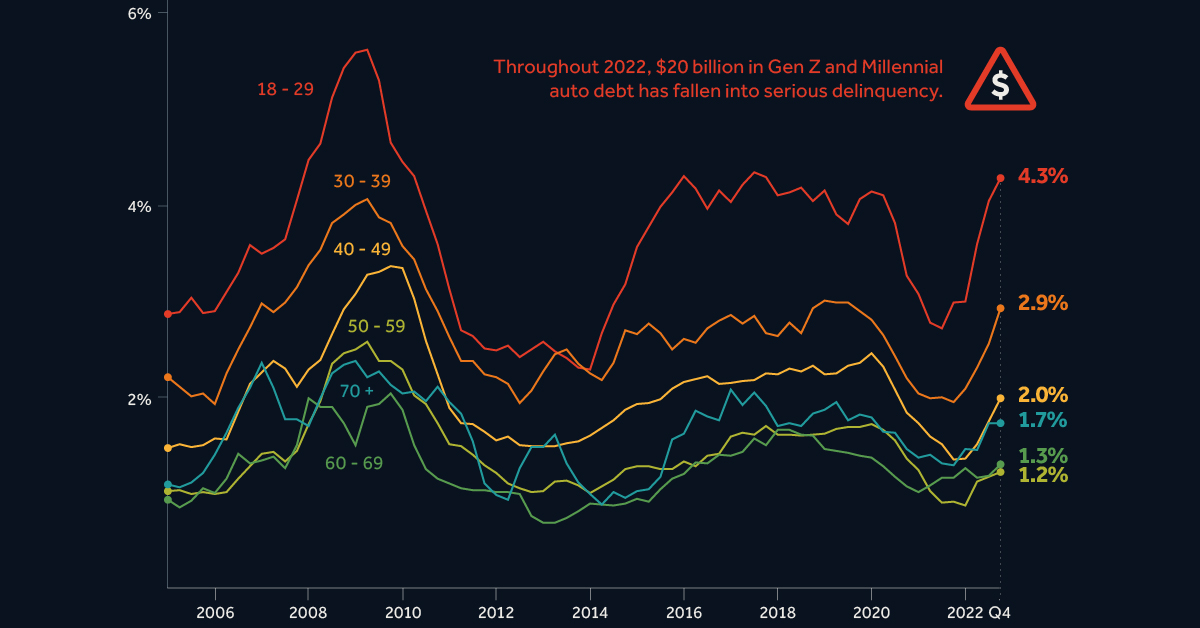

on In this infographic, we’ve visualized data from the Fed’s most recent consumer debt update.

Aggressive Borrowing

The first chart in this graphic shows the growth in outstanding car loans between Q2 2020 (start of the pandemic) to Q4 2022 (latest available). We can see that Americans under the age of 40 have grown their vehicle-related debt the most. It’s natural for Gen Z (ages 11-26) to have higher growth figures because many of them are buying their first car, but 31% is quite high relatively speaking. Part of this can be attributed to today’s inflationary environment, which has pushed used car prices to new highs. Supply chain issues have also resulted in over 30% of new cars being sold above MSRP. Because of these rising prices, the Fed reports that the average auto loan is now $24,000, up 41% from 2019’s value of $17,000.

Spiking Delinquencies

Interest rates on auto loans are typically fixed, meaning many young Americans were able to take advantage of the low rates seen during the pandemic. Despite this, one in five Gen Zs say that their car payments account for over 20% of their after-tax income. Shown in the second chart of this infographic, the amount of auto debt transitioning into serious delinquency is much higher for Gen Z and Millennials. Throughout 2022, these generations saw $20 billion in auto debt fall 90+ days behind. The outlook for these struggling borrowers is bleak. First there’s inflation, which has pushed up the prices of most consumer goods. This eats into their ability to make car payments. Second is rising interest rates, which make credit card debt—another pain point for young borrowers—even more costly. Finally, there’s student loans, which are expected to resume in summer 2023. Payments on student debt have been suspended since the beginning of the COVID-19 pandemic.