Founders are at the very ground level, and their pursuits have a ripple effect on the entire startup ecosystem. As a result, how entrepreneurs think about different subsectors within tech is of utmost importance. Not only do their perceptions influence what projects they themselves choose to build, but how founders allocate their time and energy may also be a useful gauge of where future economic potential lies. Today’s chart focuses on what entrepreneurs think of specific technologies, using data from a survey of 869 entrepreneurs that was done by First Round Capital.

Seeing Through the Hype

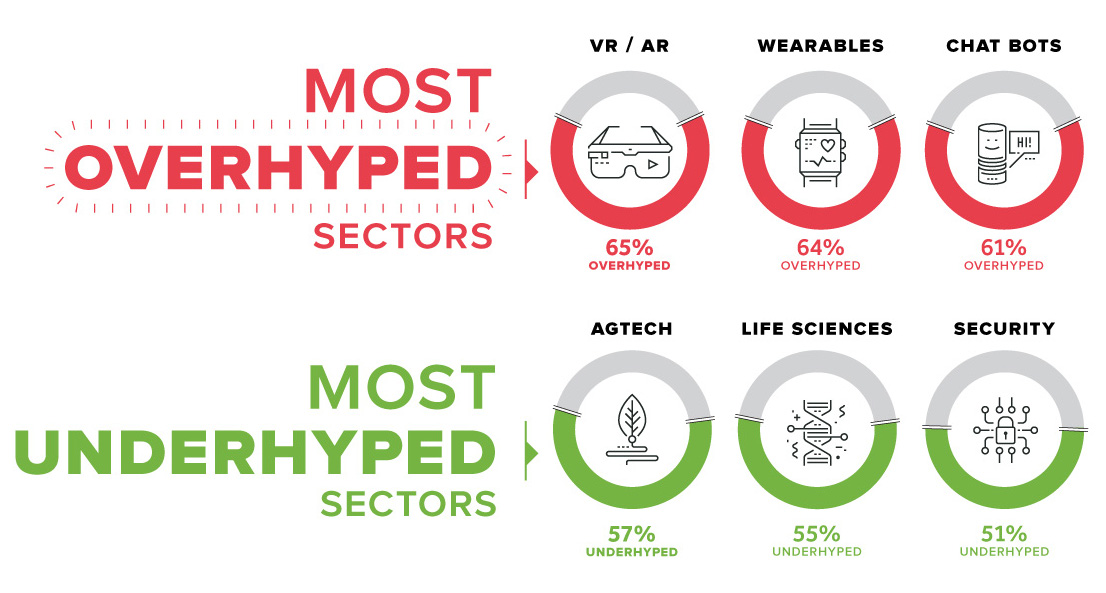

In the survey, entrepreneurs were asked to give their opinions on 14 different technologies, on whether they were overhyped or underhyped. Entrepreneurs could also answer “neutral” to any of the questions. Here are the three technologies that were considered the most overhyped:

- VR/AR: 65% Overhyped VR has been the “next big thing” for many years, with still a minimal consumer footprint. It’s not surprising that entrepreneurs see this sector as overhyped. For companies like Facebook and Magic Leap to reverse the perception of VR/AR, they’ll need to get consumers adopting these technologies at a faster rate.

- Wearables: 64% Overhyped When Google Glass first came out in 2013, hype about a future filled with wearables seemed inevitable. Now it’s almost five years later, and wearables haven’t delivered on the scale that many entrepreneurs thought was possible.

- Chatbots: 61% Overhyped Will chatbots really change customer service, health, and other industries? Most entrepreneurs seem to be a little skeptical about their potential impact.

Diamonds in the Rough?

Entrepreneurs also thought some sectors deserve more attention – and this is where there may be some potential opportunities for investors or new founders.

- Agtech: 57% Underhyped Farming is not flashy, but entrepreneurs recognize agtech as something that city slickers should pay more attention to. New tech is making agriculture more sustainable and urban, while increasing crop yields. We covered some of these interesting next generation food systems in a previous infographic post.

- Life Sciences: 55% Underhyped Advances in areas such as longevity, genomics, and biotechnology are unnerving to some people, but life sciences seems to be at a tipping point. Founders see this as an area that deserves more attention from the media and investors.

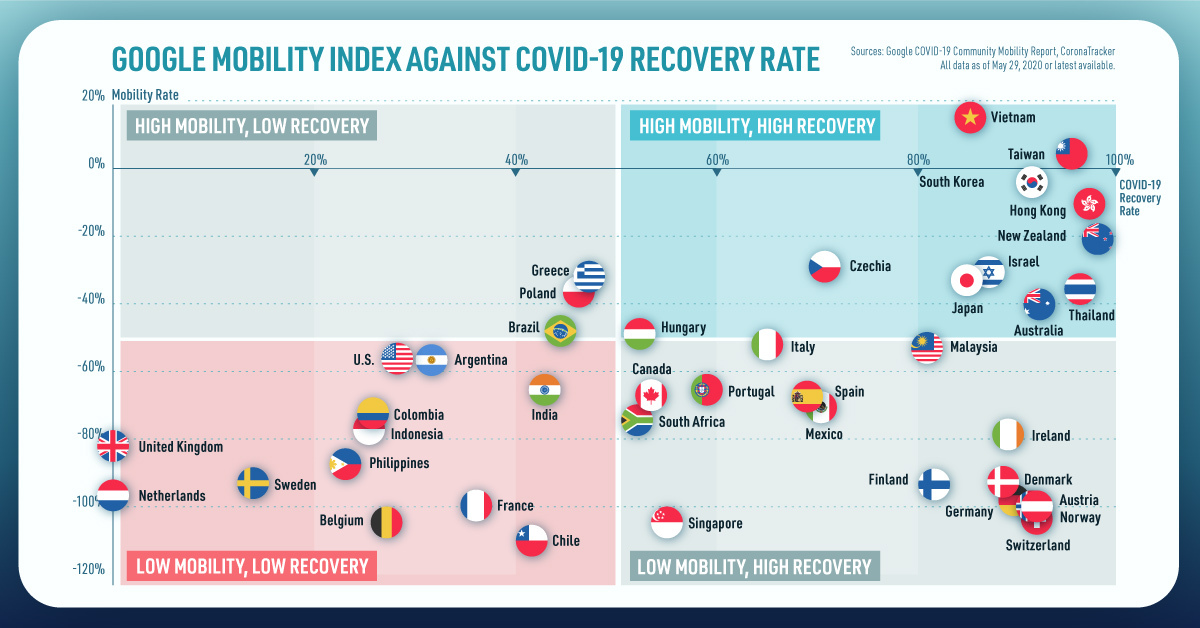

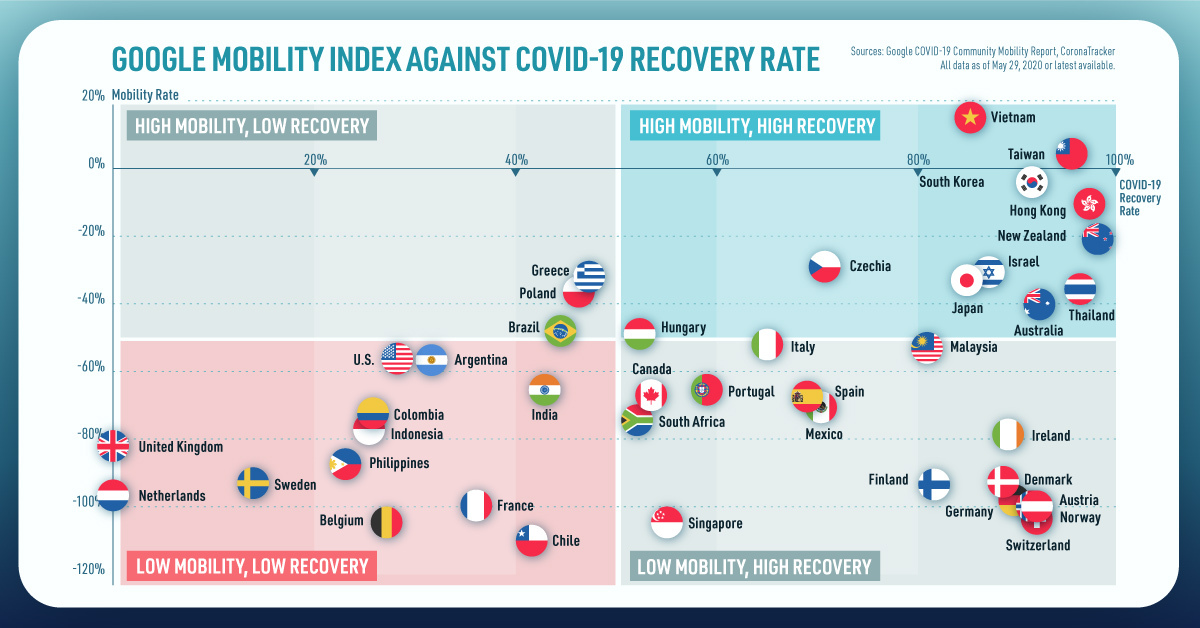

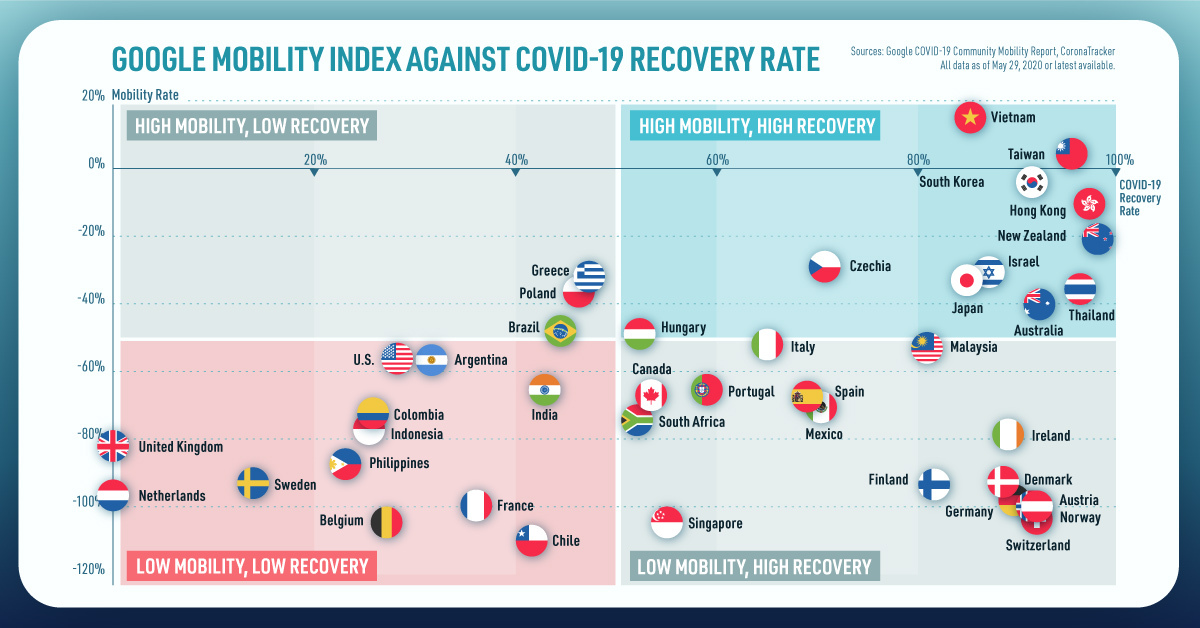

- Security: 51% Underhyped Last year, $450 billion was spent on cybersecurity – and this number is growing fast as the IoT becomes even more prevalent. Stopping hackers is not flashy, but it is vital to the global economy and many dollars will be spent on it in the coming years. on Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate: Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services. COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population. Here’s how these countries fare based on the above metrics. Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020. In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work. New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with. Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered. Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response. With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe. The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up. Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take. COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while. —Carmen Reinhart, incoming Chief Economist for the World Bank Will there be any chance of returning to “normal” as we know it?